Call Toll Free +1 855-856-TIPS

United States of America-– As troubling labor data continues to plague the construction industry everyone has begun to get creative and learn to adapt to the now evolved and never seen before labor and employee markets. The recent jobs report is a example of the ever tricky labor number interpretations.

| Category | Aug. 2020 | June 2021 | July 2021 | Aug. 2021 |

|---|---|---|---|---|

| EMPLOYMENT BY SELECTED INDUSTRY (Over-the-month change, in thousands) | ||||

| Total nonfarm | 1,583 | 962 | 1,053 | 235 |

| Total private | 1,066 | 808 | 798 | 243 |

| Goods-producing | 53 | 42 | 64 | 40 |

| Mining and logging | -4 | 12 | 6 | 6 |

| Construction | 26 | -2 | 6 | -3 |

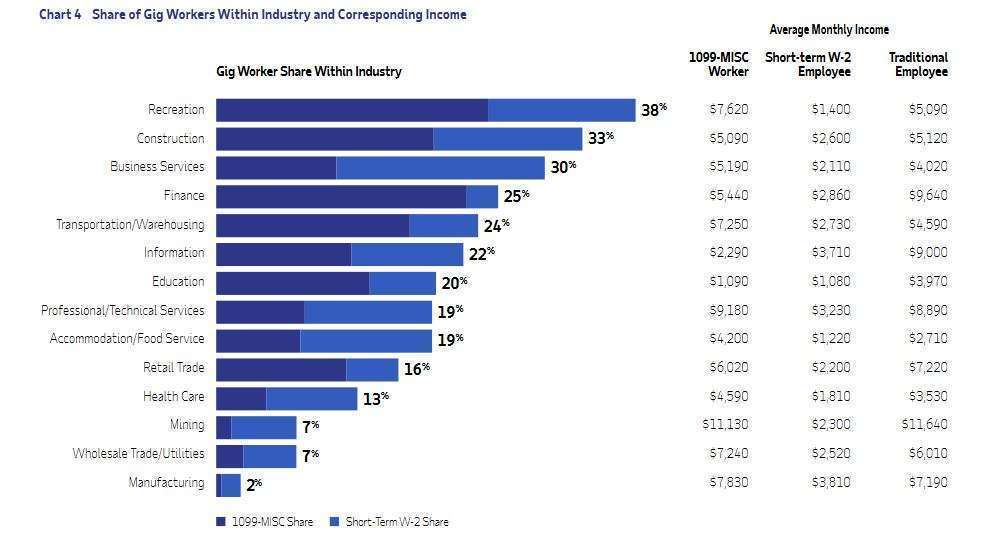

Numbers are beginning to enlighten what possibly is a large exodus from the construction trades all together and or also possibly a huge influx to self employed “on demand”, “freelance”, “gig” type workers. Another issue we face is the large cross border immigration unfolding which accounts for a large number of untracked laborers. A report published February 2020 commissioned by ADP titled “Illuminated The Shadow Workforce – Insights into the Gig Workforce In Businesses” states that:

“From 2010 to 2019, the share of gig workers in companies has increased from 14.2% to 16.4%, a 2.2 percentage point increase, or 15%. Both groups of gig workers, short-term W-2 employees as well as 1099-MISC independent contractors, contributed equally in this growth. Every indication is that gig work will only continue to grow, and with an already tight talent market, businesses will need to fully understand the dynamics of the contingent workforce — to optimize talent management, workforce strategy and the company’s bottom line”.

The report discusses Millennials and Gen Z and outlined that:

“As a whole, gig workers under the age of 34 view themselves mainly as traditional employees, perhaps reflecting a shift in what this term means to them. For 1099-MISC workers in this age group, they are more likely to be married and have children under 18, and more likely to be highly educated (with one in four possessing an advanced degree). Interestingly, while more than 50% of 1099-MISC workers under 35 say they would prefer to be a W-2 employee, the prospect of health insurance does not appear to change their job behavior. In fact, 74% say they would keep working as a 1099-MISC worker, even if they lost their current health insurance.”

”Twenty percent of gig workers are over the age of 55. Among 1099-MISC workers, the 55+ group is even higher at 30%.“

POST PANDEMIC

Since the pandemic people have changed their outlook on work and the way they want to spend their lifetimes. The strong social movements have empowered a generation of self worth and worker rights. Personal well being became most important. Suddenly the stress from the 9-5 grind halted our programmed minds. People stood across the country for things that mattered most to them in an uprising from a new generation now empowered to hold people and corporations accountable while progressing one of the largest worker rights campaigns ever.

The gig economy grew at a rate of 33% in 2020, significantly faster than the overall US economy. There are approximately 1.1 billion on-demand gig workers worldwide, and 2 million new gig workers emerged in the United States alone in 2020. According to Statista, approximately half of the US population will have engaged in gig work by 2027. Today, 35% of Americans work in the on-demand gig economy. European regions saw statistics that more then doubled.

The IRS and government have been trying to adapt as fast as they can. With the explosion of gig working the IRS has recently issued Form 1099-NEC, which covers any independent gig contractor. Until 2020, you reported payments to independent contractors in Box 7 of Form 1099-MISC as non-employee compensation. In previous years, including income in Box 7 of a Form 1099-MISC usually alerted the IRS that you should also be paying self-employment tax. It is the equivalent of both employer and employee payroll taxes on wages reported on Form W-2.

Data sets maintained by the U.S. Government have data gaps currently that don’t allow a more advanced data tracking of freelancers and gig workers yet but has been ever evolving more.

The recent jobs report although troubling and mystifying may have some underlying hidden data where emerging data is being off set by not yet aggregated freelancers and 1099’s. The next few months will shed light as more and more data is released. The large influx of border immigration and other gig economy statistics would most likely add additional information to evaluate the “crisis”.

The labor crisis has grown so competitive that the State of Vermont is offering anyone to move there and enjoy $7,500 for relocating including home down payment assistance. Vermont is also releasing a new Remote Worker Grant scheduled to be released in February 2022. The New Remote Worker Grant, with a maximum award of $7,500, is to encourage professionals who perform the majority of their employment duties remotely from a home office or co-working space to relocate to Vermont.