Call Toll Free +1 855-856-TIPS

United States Of America – Robotics and Automation are nothing new. It has been evolving consistently since Henry Ford’s assembly line and well before. What has changed is the segments and industries they never reached or reach.

The country’s lack luster adoption and lack of innovation seems to have began with push and pull lobbying and regulation unfairly benefiting the wealthy whether directly or indirectly during the Bush Presidency and beyond. Here we start to see infiltration of security in investments over the next decade with more and more reliance on oil and gas. Continued huge profit taking at the top levels of corporate and consultancies.

Technology, automation and robotics are essential, free flowing, evolving entities, ever involved and entangled in the way we do, conduct, process and convey business and the human persona.

Along with energy reliance and renewable clean power there is not anything more important to the human race at all levels. All these directly have a correlating compounding effect on inflation, worker productivity, worker overload, worker health and in turn financial security of workers and a nation.

Robotic Equipment Spending Data Report For The United States Of America

According to a new Annual Capital Expenditures Survey (ACES) estimates released this week by the U.S. Census Bureau, capital expenditures for robotic equipment in the United States totaled $9,853 million in 2020, and only accounting for 1.0 percent of total equipment expenditures. ACES estimates by business type add detail to national-level estimates of machinery and equipment investment.

The new ACES data tables provide national-level estimates of robotic equipment capital expenditures based on the 2017 North American Industry Classification System (NAICS) at the two-digit, three-digit, and four-digit NAICS levels.

In the 2018 ACES, capital expenditures for both industrial and service robotic equipment were collected for the first time. Growing interest and concern led to high demand answers from researchers, congressional members, and other groups. In turn that led to the measurement of robotic expenditures in order to provide insight into the intensity of robotic adoption and its impact on employment and productivity.

Previously, robotic equipment expenditures were linked to a company’s primary business activity. The 2020 estimates are based on a different method of data collection. Data were specifically requested for the NAICS industries in which the robotic investment was made. For more breakdown of these two please visit the data set links to compare further.

2020 & 2019 FACTS

2020

- In 2020, three sectors (Manufacturing, Retail Trade and Health Care and Social Assistance) accounted for 89.7% of total robotic equipment expenditures.

- The Manufacturing sector was the largest investor, accounting for 50.2% of all robotic equipment expenditures.

- The Retail Trade sector was the second-largest investor, accounting for 34.3% of all robotic equipment expenditures.

- General medical and surgical hospitals invested $424 million in robotic equipment and accounted for 82.7% of overall spending for robotic equipment in the Health Care and Social Assistance sector.

2019

- Eighty-seven percent of total robotic equipment expenditures were accounted for by three industries: manufacturing, retail trade, and healthcare and social assistance.

- Manufacturing was the most active investor, accounting for 65.7 percent of all robotic equipment expenditures.

- General medical and surgical hospitals spent $427 million on robotic equipment, accounting for 80.7 percent of all robotic equipment spending in the health care and social assistance sector.

2020 & 2019 Robotic Capital Expenditures Comparison

| NAICS | Industry Sector For A Breakdown Of Industry Sector Please Visit NAICS | 2020 | 2019 |

| CODE | Total | 9853 | 7,524.00 |

| 113-115 | Forestry, fishing, and agricultural services | 27 | 10.00 |

| 21 | Mining | 11 | – |

| 22 | Utilities | Z | 3.00 |

| 23 | Construction | 127 | 75.00 |

| 31-33 | Manufacturing | 4944 | 4,947.00 |

| 42 | Wholesale trade | 438 | 229.00 |

| 44-45 | Retail trade | 3383 | 1,051.00 |

| 48-49 | Transportation and warehousing | 214 | 127.00 |

| 51 | Information | 9 | 110.00 |

| 52 | Finance and insurance | 32 | 6.00 |

| 53 | Real estate and rental and leasing | 27 | 14.00 |

| 54 | Professional, scientific and technical services | 41 | 319.00 |

| 55 | Management of companies and enterprises | Z | 1.00 |

| 56 | Administrative and support and waste management | 42 | 63.00 |

| 61 | Educational services | 12 | 14.00 |

| 62 | Health care and social assistance | 513 | 529.00 |

| 71 | Arts, entertainment, and recreation | 1 | 4.00 |

| 72 | Accommodation and food services | 9 | 21.00 |

| 81 | Other services (except public administration) | 25 | 3.00 |

Not Only Robotics Expenditures Are Lack Luster

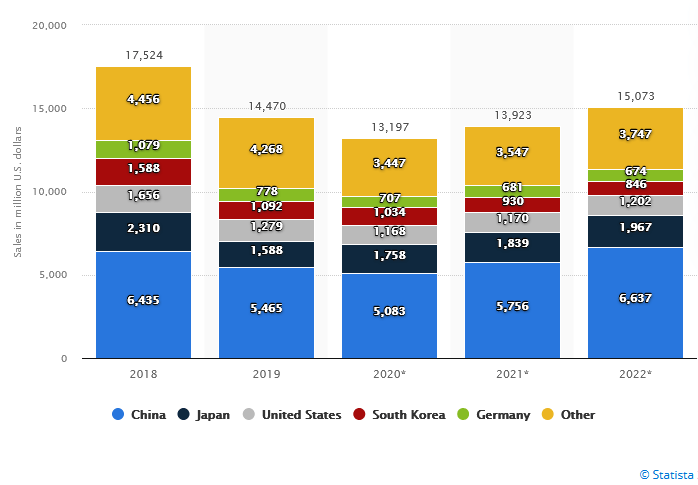

Statitista shows during Donald Trump’s tenure further relaxed, normalized this practice with open door, personal invitation policy to national threat countries further directing the United States of America’s overall sales and market value in the wrong directions while focusing on more oil and gas.

Further Robotics and Autonomous markets in 2018 was $1,656 Million with a sharp decrease in 2019 to $1,279 Million. Bylt currently only has compiled estimated forecasts for 2020 and it’s anticipated report of $1,168 Million, a forecast of $1,170 Million in 2021 and the projected 2022 data is just $1,202 Million.

We will be monitoring this evolving projected data for 2020, 2021 and 2022 as it becomes available but changes from the Biden-Harris administration over this time period is pointing to improvements and real adoption. Energy and Food independence.

The Statitista Report is based on The International Organization for Standardization (ISO). It defines an industrial robot as a “automatically controlled, reprogrammable, multipurpose manipulator, programmable in three or more axes, which can be either fixed in place or mobile.” The costs of software, peripherals, and systems engineering are not included in the figures. It combines and uses 5 data set sources.

Why Does This Point Data Matter On Robotics Expenditures, Spending & Sales?

The majority of the industrial robotics market is accounted for by five countries, with China being by far the largest. In 2018, the industrial robotics market in China was estimated to be worth more than 6.4 billion US dollars, while the market in Germany was estimated to be worth more than 1 billion US dollars.

The global industrial robotics market contraction between 2018 and 2020, is a very worrying characteristic. Except for China, most countries’ industrial application of robots either decreased or a stagnate number in the following years when compared to 2018.

The value of industrial robotic sales in China is or was expected to peak in 2022.

Dangers Seen Over The Past 5 Years Or 40 Years…

Old money. Old Mentality. Un-Intelligible Management. These 3 items seem to be the continued and current driving force leading the failure rates seen in the United States economic worries and also failed conveyance of infrastructure and supply chain operations. Not to mention national security directly.

What is Un-Intelligible Management? Few definitions if any were found when writing this analytical report besides a research paper from 1980 labeled “Unintelligible Management Research and Academic Prestige”. Although mildly off topic from this analysis the report by J. Scott Armstrong of University of Pennsylvania offers some very good insights and points.

BlackRock

Lets take a look at a real life case study and example of what inconsistencies can do to markets. BlackRock founded in 1988 following the stock market crash of 1987.

Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson founded BlackRock in 1988 to provide institutional clients with asset management services from a risk management perspective

Fink, Kapito, Golub, and Novick had previously worked together at First Boston, where Fink and his team were pioneers in the US mortgage-backed securities market. As CEO of First Boston, Fink lost $100 million during his tenure.

BlackRock also led major investment strategy and purchases of infrastructure, ports and supply chains early on. It still continues too.

Un-Ethical? Un-Sustainable? Shortsighted Leadership?

It’s no secret how BlackRock operates and speaks publicly with and apparently for our money and Country. And consistently through both parties administrations. More disturbing is it’s cozy ties with countries like it’s investments just before the war in China, Russia, Saudi Arabia and now again after the war just recently in Suadi Arabia.

It should be noted some investment right now is strategic and if it benefits the U.S. or other Ally in the short term it is fair game. But over-doing it is a risk and being associated with, and or wanting to even be socially involved with this Nations is a problem. These countries in question have made there decisions clear and in turn retaliated against the free world.

In 2022 the common person knows knows that if a country can not feed it self, take care off it self, citizens personal health, openly kills its own people and contaminates and destroys the environment shouldn’t be allowed to be involved in anything meaningful in society let alone governance of the World and surely wont be Earth representative in space.

The Cause Of The Subprime Mortgage Crisis

In a article report written by Kimberly Amadeo and Erika Rasure in January it states The subprime mortgage crisis was caused by these same means and methods via hedge funds, banks, and insurance companies. Mortgage-backed securities were created by BlackRock, pioneered, lobbied, pushed and sold quickly to the Clinton administration. Credit default swaps were used to protect the insurance companies. Mortgage demand fueled a housing asset bubble.

When the Fed raised the federal funds rate, adjustable mortgage interest rates skyrocketed. As a result, home prices fell and borrowers went into default. Derivatives disseminate risk all over the world. This resulted in the banking crisis of 2007, the financial crisis of 2008, and the Great Recession. It precipitated the worst economic downturn since the Great Depression.

Why This Happens

In hinds sight its not easy to spot. But now in 2022 and its Factually Obvious now. The President has been proactively addressing these problems with corrective measures, bills, and law over the last two years and we see how a small percentage of politicians and money managers who should and do know better can be corrupted and skewed by foreign interests with the sole goal of to de-stablize the United States of America, the World itself and it’s allies whether through worker rights, supply chain disruptions, oil & gas, domestic and foreign terrorism, assassinations of journalists and so on.

We are seeing first hand how this corrupted mentality and leadership brought through our own American main stream channels like in Texas, Florida specifically while speckled throughout the nation and how foreign influence on corrupted Americans can result in our own supply chain, financial instability and most importantly National Security.

These money managers controlling the people of United States Of America incorrectly and dangerously can and has resulted in a mentality of leadership the has brought back American technology and ideology 20 years in the terms of non-investment correctly.

Current Investment Strengths & Jobs Well Done

The path forward is wide open and we have made tremendous cycle swings as a whole, The World. Those problems of stalled policy and johnny come lately mentality are no longer our problem or concern and they will be left behind, disappear or become unlawful if not already. Not invited to the party.

The points are clear that are needed for continued strong investment. Robotics, Automation, Renewables & Agriculture, and Infrastructure needed is what will reap the returns both mentally and financially for the World.