Call Toll Free +1 855-856-TIPS

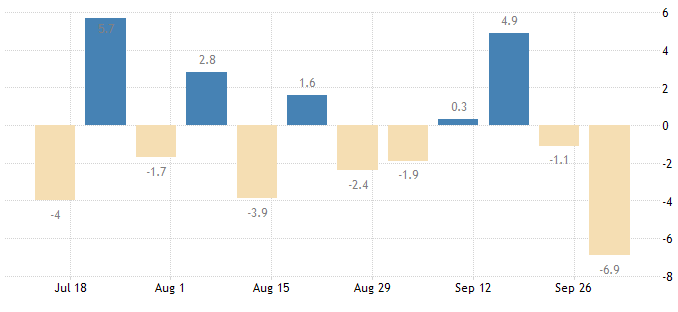

U.S. Mortgage Applications Sink 6.9%, 30YR Rate 3.14% Week End October 1, 2021

Washington D.C. – Mortgage applications in the United States fell 6.9% in the week ending October 1st, the biggest drop since the last week of June, according to data from the Mortgage Bankers Association, as interest rates continue to rise amid soaring bond yields.

Refinancing applications fell 9.6% to the lowest level in three months, while home purchase applications fell 1.7 percent.

The average fixed 30-year mortgage rate jumped to 3.14 percent this week, the most since early July and up from 3.1 percent the week before.

Higher rates are deterring borrowers from refinancing, as decreases were recorded across the board. However, this was insufficient to reduce the average debt balance of $410,000. With home values continuing to rise and sales prices remaining high, applications for higher-balance, conventional loans continue to dominate the mix of activity, according to MBA economist Joel Kan.

In the week ending October 1st, 2021, fixed 30-year mortgage rates in the United States averaged 3.14 percent, the highest since early July.