Call Toll Free +1 855-856-TIPS

United States Of America – The U.S. Department of Energy’s Wind Energy Technologies Office has released its 2023 Wind Market Reports. The 2023 Edition reveals that wind power serves as one of the fastest growing and least expensive sources of energy in the United States. Its rapid growth has been attributed to the Inflation Reduction Act.

Offshore Wind Market Report: 2023 Edition

The goal of the 2023 Offshore Wind Market Report is to inform policymakers, researchers, and analysts about new technological advancements, economic shifts, and market trends of offshore wind energy industries in the U.S. and across the world. The report covers global operating offshore wind energy projects and developments from December 31, 2022, to May 31, 2023.

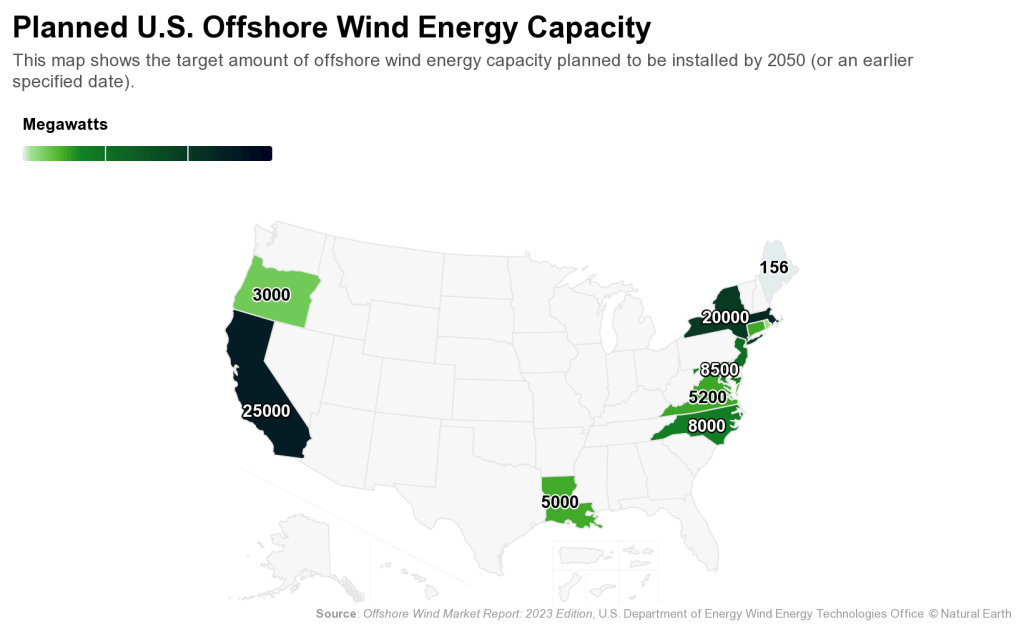

By May 31, 2023, it is projected that the U.S. offshore wind energy project development and operational pipeline will reach a generating capacity of 52,687 megawatts. This represents a 15% growth form the 2022 Offshore Wind Market Report. Approximately 6,915 MW of growth in the U.S. project pipeline capacity are attributed to new leasing activity which established three new lease areas in the Gulf of Mexico holding an estimated capacity of 4,855 MW.

The Inflation Reduction Rate, which was signed in August 2022, provides incentives for investing in offshore wind energy and focusing on the domestic supply chain. The Act extends offshore wind’s eligibility for an investment tax credit of 30% for a decade. Additionally, the IRA includes bonus credits of 10 percentage points for meeting domestic content thresholds. Manufacturing credits are given for the domestic production of various clean technology components such are wind turbine blades, nacelles, towers, foundations, and purpose-built offshore wind vessels.

Projects with an expected state of commercial operations between 2025 and 2028 have faced challenges in maintaining economic viability due to increasing capital costs and interest rates. Consequently, some projects have requested for their counterparties or states to renegotiate the terms of their offtake agreements. Some states have introduced inflation indexing for offshore wind procurement to make future offtake agreements more durable.

In December 2022, the first ever commercial floating offshore wind energy lease areas off the coast of California, were sold for $750 million. California has also announced a goal of planning 25 GW by 2045. Earlier, in September 2022, the Biden administration announced the Floating Offshore Wind Shot which serves as a nationwide effort to decrease the cost of floating offshore wind by 70% or $45/megawatt-hour. The U.S. Department of the Interior has created a deployment target for 15 GW of floating offshore wind capacity to be installed by 2035. Additional commercial leasing for floating wind in the Atlantic and Pacific regions is anticipated.

Over $2.7 billion was used across port, vessel, supply chain, and transmission U.S. offshore wind energy markets in 2022. Nearly $1 billion was focused on 12 ports and eight vessels. The U.S. offshore wind energy industry currently has 28 vessels that have been announced or are under construction.

The Bureau of Ocean Energy Management held three offshore wind lease auctions in 2022. Thirteen leases were sold totaling $5.44 billion in sales. The new lease areas increase the amount of viable offshore wind energy sites within the U.S. and provide regional diversification. Among these sales, the first deep-water commercial leases were introduced to the U.S. floating offshore wind industry.

Twenty-seven contracts to purchase 17,567 MW of electricity from offshore wind power plants have been signed. Despite this, no new offtake agreements were signed between June 2022 and May 2023. Yet, state policies aim to acquire 42,730 MW of offshore wind capacity by 2040. Seven states have durable statutory procurement mandates which mandates 42,730 MW by 2040. Six other states have offshore wind specific planning targets. This year, Maryland and New Jersey increased their statutory procurement mandates to 11 and 8.5 GW. In sum, 13 coastal states have announced planning targets or mandates for offshore wind energy which will have a total of 112,286 MW of offshore wind capacity by 2050.

2023 Offshore Wind Market Report Key Findings, Costs & Price Trends

- Global offshore wind energy had its second best year in 2022. Over 8,385 MW were commissioned from new projects.

- The global generating capacity potential in the pipeline for all offshore wind energy projects has reach 427 GW in 2022.

- Inflation and the war in Ukraine have created market volatility, disrupted the supply chain, and increased project costs.

- In 2022, the global pipeline for floating offshore wind energy has increased by approximately 42 GW.

- The floating wind global capacity remained at 123.4 MW as a result of no new global floating offshore wind energy projects coming online in 2022.

- Offshore wind turbines in the 15-MW class have been advancing in commercial production.

- Supply chain restrictions, inflation, and increasing interest rates have caused the cost of projects to increase between 11%-30% during 2022.

Global forecasts have indicated that offshore windy energy may reach between 380 GW and 394 GW by 2032. The National Renewable Energy Laboratory revealed that the U.S. needs about two terawatts (2,000 GW) of wind and solar capacity to serve a threefold expansion of electric energy consumption. For the U.S. to accomplish this, between 1,000 GW and 1,200 GW of wind energy will be necessary alongside a contribution from offshore wind.

Key offshore wind market indicators including commercial leasing, state energy planning targets, procurement policies, offtake agreements, and federal support for U.S. jobs and supply chain development, point towards market growth when viewed together. However, macroeconomic obstacles which commercial projects are encountering, may substantially stunt and delay such market growth.

2023 Land-Based Wind Market

The Land-Based Wind Market Report contains an overview of developments and trends of the U.S. wind power market in 2022.

In 2022, over $12 billion was invested in the expansion of land-based wind energy. Additionally, 8.5 gigawatts were added to the U.S. land-based wind energy capacity. Nevertheless, 2022 proved to be a slow year in the deployment of new wind power due to ongoing supply chain pressures, higher interest rates, interconnection and siting challenges, and the reduction in the value of the production tax credit with the passage of the Inflation Reduction Act (IRA) in August 2022.

The IRA promises new market dynamics for wind power deployment and supply chain investments. The Act includes a long-term extension of the PTC at full value and new production-based and investment-based tax credits. These tax credits would support the growth of domestic clean energy manufacturing. The IRA has made a promising impact of analyst forecasts for future wind power capacity additions and improvements in the wind industry supply-chain.

The 2023 Land-Based Wind Market Report primarily focused on land-based, utility-scale wind. Key findings in installation trends, industry trends, technology trends, performance trends, cost trends, power sales price and leveled cost trends, and cost and value comparisons were uncovered.

Installation Trends:

- Wind power serves as the second largest source of U.S. electric-power capacity additions at 22% in 2022. Solar power is at 49%.

- The United States was ranked second, globally, in annual wind capacity. Yet, the U.S. remains behind and outdated among market leaders in wind energy penetration.

- Texas has installed the most wind capacity in 2022 at 4,028 Megawatts. Oklahoma trails behind at 1,607 Megawatts. Additionally, 12 states have exceed 20% wind energy penetration.

- Hybrid wind plants saw limited growth in 2022. Only one new project was completed.

- An astonishing, recording breaking 300 GW of wind power capacity now exists in transmission interconnection queues. Solar and storage, however, are growing at a much rapid pace.

Industry Trends:

- Four turbine manufactures supplied all of the utility-scale wind power capacity installed in 2022 in the U.S.

- In early 2022, the domestic wind industry supply chain was on the decline but the Inflation Reduction Act repaired optimism regarding supply-chain expansion.

- Domestic manufacturing for some wind turbine components is powerful but the U.S. still largely remains reliant on imports.

- Independent power producers own most wind assets which were built in 2022.

- Non-utility buyers have entered into more contracts to purchase wind than utilities in 2022.

Technology Trends:

- Turbine capacity, rotor diameter, and hub height have increased substantially.

- The market is dominated by turbines designed for lower wind speed sites. The trend towards lower specific power has recently reversed.

- Wind turbines were deployed in higher wind-speed sites in 2022 at a greater rate than in prior years.

- Low-specific-power turbines are being deployed in all regions. Taller towers are being used in a wider variety of sites.

- Wind projects that are planned for the future will accelerate and continue the trend of ever-taller turbines.

- 13 wind projects were repowered in 2022. The updated projects now have larger rotors and lower specific power ratings.

Performance Trends:

- In 2022, the average capacity factor was 36% on a fleet-wide basis and 37% among wind plants constructed in 2021.

- Capacity factors are the highest in the central region of the U.S.

- Declining specific power leads to sizable increases in capacity factor over the long term.

- Across seven regions, wind power curtailment averaged 5.3% in 2022. In 2016, the curtailment was 2.1%.

- The 2022 year was an above-average wind resource year for a majority of the U.S.

- Wind project performance degradation explains why older project failed to perform satisfactorily in 2022.

Cost Trends:

- The cost of wind turbines increased in 2022 due to supply chain pressures and elevated commodity prices. The average price was $1,000/kW.

- Installed costs vary by region.

- Installed costs per Megawatt standardly decline with project size.

- Operations and maintenance costs differed based on project age and commercial operations date.

Power Sales Price and Leveled Cost Trends

- Wind power purchase agreement prices have steadily been increasing since 2018. The price is now approximately $40/MWh compared to $20/MWh in 2018.

- Data from Level Ten Energy reveals that prices have risen over the past few years and that they vary based on region.

- A small sample of projects completed in 2022 have uncovered that the average leveled cost of wind energy fell to around $32/MWh.

Cost and Value Comparisons

- Wind now faces competition from solar and gas considering solar prices have fallen more rapidly than wind prices over the past decade.

- The grid-system market value of wind increased across many regions in 2022.

- The grid-system market value of wind in 2022 varied by project location. The average ranged from $18/MWh in SPP to $83/MWH in ISO-NE.

- The grid-system market value of wind usually declines with wind penetration. The market value is impacted by generation profile, transmission congestion, and curtailment.

- The health and climate benefits of wind are much greater than its grid-system value.

As for the future, energy analysts and research anticipate increased wind deployment as a result of the Inflation Reduction Act. The prospects of wind energy in the longer term will be heavily influenced by the Act which provide extensions and expansions of deployment-oriented tax credits and new incentives for the buildout of domestic supply chains.

2023 Distributed Wind Market Report

The 2023 Distributed Wind Market Report gives stakeholders market statistics and analysis of market trends for wind technologies. The report considers the wind market from 2003 to 2022. Key findings in respect to installed capacity, deployment trends, customer types, incentives, policies, and installed costs and performance have been evaluated:

Installed Capacity:

- All U.S. distributed wind capacity installed from 2003 to 2022 generate 1,104 MW from over 90,000 wind turbines across all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, the Northern Mariana Islands, and Guam.

- In 2022, 13 states contributed 29.5 MW of new distributed wind capacity from 1,755 turbine unites. This represented $84 million in investment.

- 29.5 MW were installed in 2022. Of those, 27.2 MW came from distributed wind projects that used large scale turbines which were greater than 1 MW in size.

- There are no reported distributed wind projects in 2022 that used midsize turbines (101 kW to 1 MW in size).

- 2.3 MW of small wind turbines (up through 100 kW in size) were deployed in the U.S. throughout 2022. There were 1,745 turbine units representing $14.6 million in investment.

- Iowa, California, and Nebraska collectively represented 92% of the distributed wind capacity installed in 2022.

- Minnesota added the most small-wind capacity in 2022 with 327 kW.

Deployment Trends:

- General Electric Renewable Energy serves as the only consistent U.S.-based manufacturer of large-scale turbines used in distributed wind projects over the past decade.

- Small wind repowers accounted for a reduced portion of small new wind capacity deployment in 2022 compared to prior years.

- In 2022, 90% of distributed wind projects were deployed to provide energy for on-site use. 10% of projects were interconnected to a distribution grid to provide energy for local use.

Customer Types:

- Projects for agricultural customers accounted for 33% of all projects installed in 2022.

- Distributed wind deployed for utility customers represented the largest share of distributed wind capacity installed in 2022. This account for 78% of documented capacity.

Incentives and Policies:

- The Inflation Reduction Act established long-term incentives for distributed wind which will be made available for the next 10 years.

- The IRA gives new loans and grant authority which could significantly benefit distributed wind.

- Distributed wind projects across eight states received $5 million in state level PTCs and USDA REAP grants within 2022.

- 23 different small wind turbine models have been certified to the American Wind Energy Association. Nine small wind turbine models have current certifications as of June 2023.

- In October 2022, the American Clean Power Association published its new American National Standards Institute consensus standard.

Installed Costs and Performance

- The average capacity-weighted installed cost for new small wind projects from 2013 to 2022 was $10,670/kW.

- The average capacity-weighted installed cost for projects using turbines larger than 100 kW between 2013 and 2022 is $4,050/kW.

- The average capacity factor in 2022 for a sample of small wind projects was 15%.

- In 2022, the average capacity factor for a sample of distributed wind projects using turbines greater than 100 kW was 23%.

- 60% of the distributed wind projects PNNL analyzed had higher capacity factors in 2022 than in 2021.

The Inflation Reduction Act and its long-term incentives for distributed wind has raised optimism regarding the future distribution of wind deployment.