Call Toll Free +1 855-856-TIPS

United States Of America – Lumber prices on CME Futures board were down 4% today after being 70% higher then its August low. On Tuesday evening, US stock futures drifted lower following a lackluster session and as investors awaited key earnings and inflation data. Dow futures fell 60 points, while S&P 500 and Nasdaq 100 futures fell 0.22 percent and 0.28 percent, respectively.

The Consumer Price Index, which is scheduled to release Wednesday morning, is expected to confirm the inflationary pressures created by supply-demand imbalances.

Consensus forecasts indicated a 5.3 percent increase in the CPI for September compared to the same month last year.

Third-quarter earnings season will also get underway, with JPMorgan, BlackRock, and Delta Air Lines all scheduled to report before the market opens. Additionally, the FOMC’s September meeting minutes will be released on Wednesday.

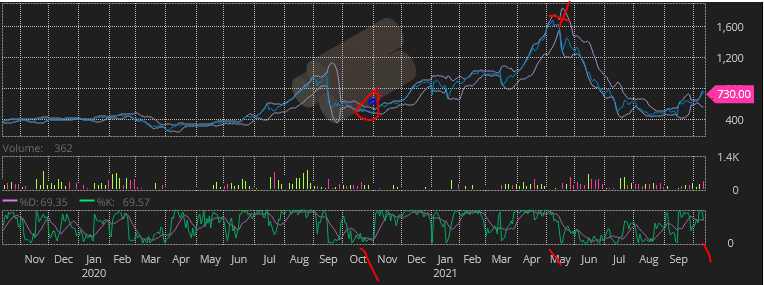

LUMBER

Lumber fell 4% Tuesday to $730 per thousand board feet, but after a steady climb, Chicago lumber futures rose to above $760 per thousand board feet, the highest level in three months, and were nearly 70% higher than their August low on supply constraints and increased demand.

The tightening labor market and wildfires in western Canada resulted in transportation issues and high log prices. Meanwhile, the decline in prices reintroduced DIYers, builders and multifamily putting additional pressure on wood costs. Nonetheless, lumber prices remain more than 55% lower than the record high of $1,711.2 set in May.

Developers, Purchasers & Builders have tough choices to make on whether to wait it out and buy cash on spot prices or buy contracts now for spring projects. CME Futures for March 2022 deliveries hit $790.00 today, a steady increase over the last few weeks.

Risk is extremely high and the charts are starting to mimics this time last year. The markets can very easily see themselves in the same exact position as last year this upcoming season. Today’s price was $730 and this time last year it was $630.

INFRASTRUCTURE BILL

Lumber will most likely be in strong demand if and when the bill is passed. We do not see many options for the country not to do it. The social spending bills will also spur huge housing initiatives and reinvestment. Democrats enjoy recent zoning law victories across the country opening up large scale building. All these factors as well as supply chain and labor crunches can very easily put is in a similar situation as last season.

INFLATION, DEBT CEILING & POLITICAL UNCERTAINTY

All over your t.v. screens and phones you can see the outright dysfunction in protocol across politics and intense geopolitical climates. Two parties pulling in different directions. With so many political agendas hovering over the industry risks and decisions have become extremely difficult, time consuming and volatile. Close eyes will need to be on productivity in U.S. Government over the next few weeks as Democrats compromise to try to bring these deals together.

America is still on life support and we can very easily still see a financial collapse and economic chaos as benefits for unemployment ran out, the holidays, lack of workers and hires.

CRYPTO

Crypto has taken huge resources from the U.S. Governments assets. Representatives and experts are dealing with the urgency of regulation on crypto that is intertwined into the Infrastructure bill and the U.S. economic future as we know it.

A recent string of 2 factor authorization scams from “employees” of cellular providers resulted in millions of dollars in thefts from Coinbase accounts and others in the recent weeks also leading to mass public interest.

CONCLUSION

Lumber prices can make or break a project with the volatility ranges we are seeing, bankrupting a project. Builders and developers need to think deep on what the budget has, currently, and weigh comfort-ability with risk. Every project is different and sometimes smart purchasers and developers simply would rather make the purchases now gaining peace of mind. The market has gained significant investment the past few months up in to today via announcements from the largest players investing in timber land, mills, mergers and relocation from Canada. Whether this will be enough and in time is yet to be unknown, but, with capital investment comes increased overheads. Mills will need this investment in automation to keep up with demand and the shrinking labor force.